With ever increasing sales via digital channels, the correct accounting treatment for revenue and VAT is ever more material. However, many find themselves falling short of the correct accounting.

Historical approach

Does this work in practice?

For many, this technically correct approach can cause difficulties in practice both for the business and for the technical solution.

Consider a digital sale with multiple fulfilment paths for a single order – perhaps an own-dispatch and a drop-ship vendor dispatch – retailers can face challenges collecting multiple partial settlements against a single pre-auth, and this can introduce risk.

Many retailers simply collect the funds at digital checkout, and so by the time the sales order is created in SAP, the money has already been collected.

This simplified approach means that the payment is received prior to dispatch – and more significantly, prior to the recording of revenue and output VAT.

How can we achieve the correct accounting in SAP?

VAT Notice 700 s14.2.2 states that VAT is due at the earlier of invoice or receipt of payment.

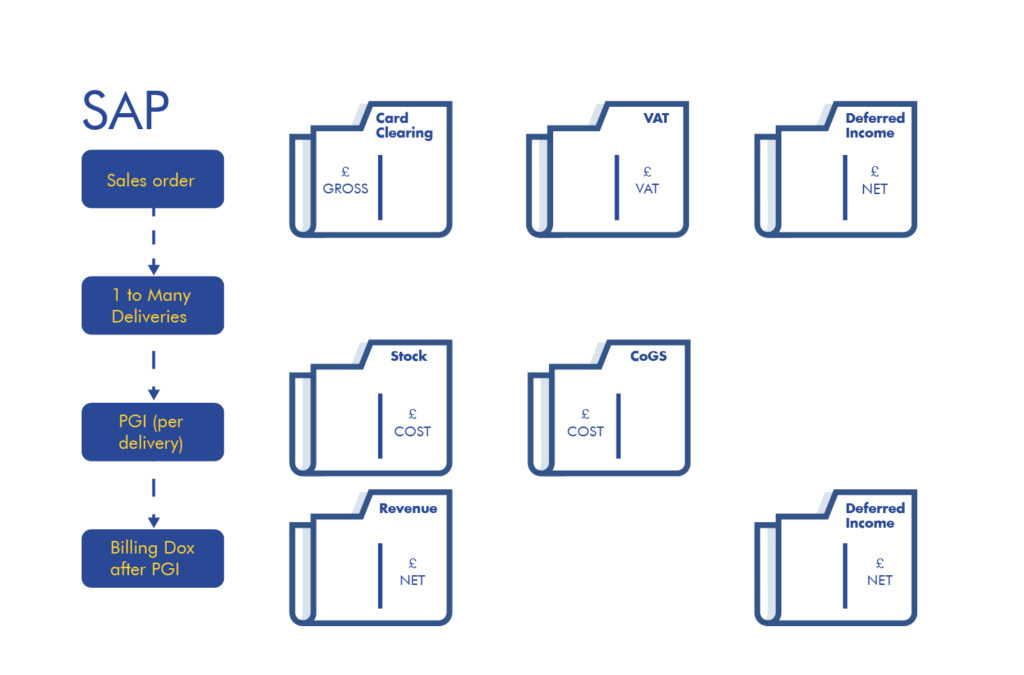

Assuming that the paid-for SAP sales order is created after the checkout, the correct accounting as per FRS 102 s23 is as follows:

A solution to ensure the accounting matches the most up-to-date state of the amended order.

- PASàPAS has developed a solution that ensures all key requirements are met:

- The deferred income and VAT postings are made at the point of order creation in SAP

- Postings are adjusted as value-change amendments are made.

- Keeps an audit trail of the journals

- Is driven by table-based configuration

- Facilitates changes and expansion to additional business processes or postings without the need for further development

Our solution has been live in a high-volume retailer for over two years, often processing over 40,000 orders a day.

For further information or to book a conversation, click here to speak to our team.